Business and Leadership

The Family Business:

Family-owned and -operated businesses are a major contributor to the American economy. A recent study by SCORE (Service Corps of Retired Executives) noted that there are 28.8 million small businesses in America; and of those, 19% are “family owned.” They define “family owned” as “any business in which two or more family members operate the company and the majority of ownership and control lies within a family.” If sole proprietors are counted as family-business owners, this number surges to over 65% of small businesses. Some of these are quite small, while others have thousands of employees; yet these businesses have a significant impact on the economy. SCORE’s findings report that family-owned businesses employ 60% of the US workforce and create 78% of all new jobs, while generating 64% of America’s gross domestic product (GDP).

While I don’t have exact data, my guess would be that in the world of sheds, family-owned businesses are represented in similar number and potentially even higher percentages. Most of the companies I work with are family owned, with at least a husband and wife serving as co-owners and occasionally a few second-generation owners. This represents opportunities not only for building family wealth, but also for providing employment and leadership opportunities for family members and building and maintaining workplace cultures that represent family values. These aspects of building a family legacy provide significant motivation for starting and operating a family business.

I grew up in a family business that was founded and run by my dad and mom. We had other employees, but day-to-day operations included and involved our whole family. About twenty years in, I became a partner with my dad and eventually bought the business from him. As we began the process of transitioning from generation one to two in our family business, I realized that I knew little about such matters, and fortunately we had a few good people helps us in making the transition.

While many idealize family business – and there are many unique opportunities for families who own and operate businesses, there are also some challenges that must be addressed in order for these businesses to be a blessing and not a burden or source of family conflict. Some of those challenges may not be unique to family businesses, but family dynamics often factor in and add complexity to them in a family context. SCORE states that 30% of family businesses survive the transition from first to second generation ownership. Only 12% survive the transition from second to third generation and only 13% remain in the family after 60 years. Nearly 47% of family business owners who anticipate retiring within five years have no succession plan for their business.

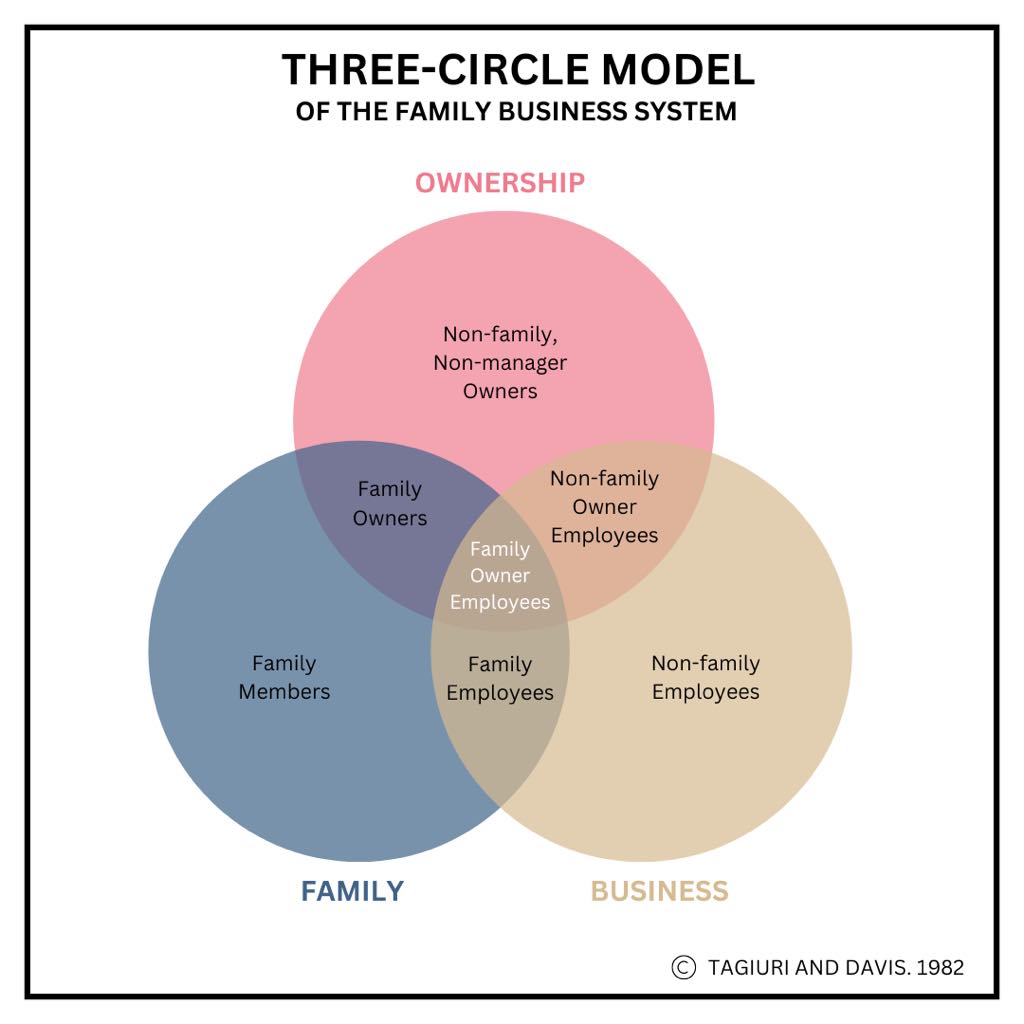

I don’t consider myself an expert in any way on this subject, but it is an area of great interest because of our own experience. In my current work with family businesses, there are a number of challenges I see showing up consistently and to which I am paying attention in the hopes of assisting families in these critical moments. One of the helpful resources I’ve found is a model developed by Renato Tagiuri and John Davis at the Havard Business School in 1978. This is often referred to as the Three-Circle Model of the Family Business System and helps to address the particular issues, interests, and concerns of the various parties in a family business. I’ll summarize the model briefly but hope to return to the subject in later articles.

This Three-Circle Model represents the three interdependent and overlapping groups in the family business system: family, ownership, and business. Every individual in a family business system is represented by one of the seven sectors demonstrated in this model and listed here for clarity sake:

- Family members who are not in the business

- Family members who are not owners but are employed in the business

- Family owners who are not employed in the business

- Family owners who are employed in the business

- Owners who are not family members and who are employed in the business

- Owners who are not family members and who are not employed in the business

- Non-family, non-owners employed in the business

Many of the tensions that arise are due to the differing views represented by each of these seven interest groups. Each group has a valid perspective that needs to be considered and respected if the company is to remain healthy and thriving. Each circle needs strong leadership; there must be clarity on what the primary concerns are within its circle and how those concerns impact, overlap, or are differentiated from those of the other circles.

Let’s start with the question of leadership and a summary of each circle’s primary concerns. Leaders in the business circle are most easily identified and those roles and concerns most clearly defined. At its most rudimentary level, the goal and primary concern of business is profit. Without profit, businesses die. While there are many supporting factors that leadership must define and manage, ultimately the profit and loss statement will determine the success and continuity of a business.

The leader of the business is its CEO (Chief Executive Officer). He is responsible to run the business so that it achieves the desired level of profitability justifying the purpose for which it exists. In order to do this, the CEO must ensure that every person in the company fits the company culture (because the health of the culture is a significant contributing factor to its performance), is well qualified to do the work for which he is responsible, and is being compensated at the market rate. Keeping people on payroll for other reasons is not responsible business leadership and negatively impacts the business and owners. Employing an “Uncle Fred” who is unsuited to a position (because he really needs a job) is just a subtle way of putting him on private welfare. This is a family matter that needs to be funded in a different way!

When it comes to the other two circles, goals and concerns tend to be a bit less obvious. Bringing clarity to these areas can relieve much of the stress for the family business. The owner’s circle, for example, is comprised of all those who own an equity stake in the business. They must have or develop clarity about what owners want and need from the business. In order to achieve this, they too must have a designated leader. This leader is also referred to as the CEO, but in this case the letters mean Chief Equity Officer. He must lead his group to determine the basic strategy of the business and their goals for the accrual or disbursement of equity in the business, as well as hiring the right person as CEO (Chief Executive Officer) of the business itself. Who becomes an owner in the future, and on what terms and at what price, are determined by this group, not one of the other circles. Those rules are defined by the group themselves through careful and strategic negotiation and are a result of what they want or desire to accomplish.

The other circle is the family itself. To competently navigate the complexities of a family who is also in business, several items need to be abundantly clear. Wherever clarity is required, leadership is essential; thus the family, too, needs a CEO. In this case he is a “Chief Emotion Officer.” Every family member, by right of birth or adoption, has a seat at this table. The CEO must work to achieve harmony around the relational and emotional health of this group. He provides leadership around family traditions, personal and family matters and how they as a family will do life together. In most families, not all members will be owners in the family business or employees of the family business, so business should never be a matter for the family at large to discuss. A family member does not have a seat in the owners’ circle or business circle by right, but only as negotiated with the leaders of those circles.

I acknowledge the possible addition of a fourth circle as very helpful for some larger family businesses, and I hope to give this more attention in the future. Some companies would benefit from another group: a board of directors. This can bring a level of stability and experience to companies around matters such as strategy, governance, and succession.

Meanwhile, work to achieve clarity in your family business around the three circles. This sort of clarity has potential to ignite the kind of growth in the company that will soon require board governance!